- #Selling general and administrative expenses pro

- #Selling general and administrative expenses professional

#Selling general and administrative expenses professional

remaining balance comprises of reclassifications of historical expenses such as rental income and HSE professional fees.reclassification of historical insurance and property tax expenses of $0.8 million, $0.7 million, and $1.6 million for six months ended Jand 2016, and year ended December 31, 2016, respectively, from cost of services to selling, general and administrative expenses and.The adjustment to reclassify RockPile’s historical expenses between selling, general and administrative expenses and cost of services include the following adjustments:

#Selling general and administrative expenses pro

The net pro forma adjustment to selling, general and administrative expenses is comprised of the following items: RockPile Six months ended JSix months ended JPredecessor (January 1 - September 7, 2016) Successor(September 8 - December 31, 2016) Combined year ended DecemEliminate transaction costs related to the Rockpile Acquisition $ (2,363 ) $ - $ - $ - $ - Reclassify RockPile's historical expenses between selling, general and administrative expense and cost of services 649 669 944 461 1,405 Adjust for new compensation arrangements with RockPile personnel (2,082 ) 325 450 156 606 Pro forma adjustment to selling, general and administrative expenses $ (3,796 ) $ 994 $ 1,394 $ 617 $ 2,011 The adjustment to eliminate transaction costs related to the RockPile Acquisition includes the elimination of legal and other professional fees incurred during the historical period that are non-recurring but are directly attributable to the transaction. Selling, General and Administrative Expenses.

and that are not included in the statement of net business assets.

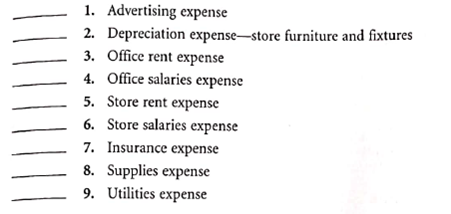

and an allocation of depreciation expense for the other corporate-level assets utilized in the operations of the ISIS Division that will not be acquired by Photon Dynamics, Inc. Depreciation Expense The statement of loss and changes in net business assets includes depreciation expense related to the equipment to be acquired by Photon Dynamics, Inc. It is not practicable to provide a detailed estimate of the expenses that would have been recognized if the ISIS Division would have been operated on a stand-alone basis. The total of these allocations was $647,821 in 2002. These methods primarily consisted of allocating costs based on (i) number of employees, (ii) percentage of office space or (iii) estimated percentage of staff time used. Where determination based on specific usage alone have been impracticable or are reflected in a general charge that is not specific to the ISIS Division, other methods and criteria were used that management believes are equitable and provide a reasonable estimate of the cost attributable to the ISIS Division. Selling, General and Administrative Expenses. The statement of loss and changes in net business assets includes a portion of the Company's shared selling, general and administrative expenses based on identification of such services specifically used by the ISIS Division.

0 kommentar(er)

0 kommentar(er)